To many people, Mutual Funds can seem complicated or intimidating. We are going to try and simplify it for you at its very basic level. Essentially, the money pooled in by a large number of people (or investors) is what makes up a Mutual Fund. This fund is managed by a professional fund manager.

To many people, Mutual Funds can seem complicated or intimidating. We are going to try and simplify it for you at its very basic level. Essentially, the money pooled in by a large number of people (or investors) is what makes up a Mutual Fund. This fund is managed by a professional fund manager.

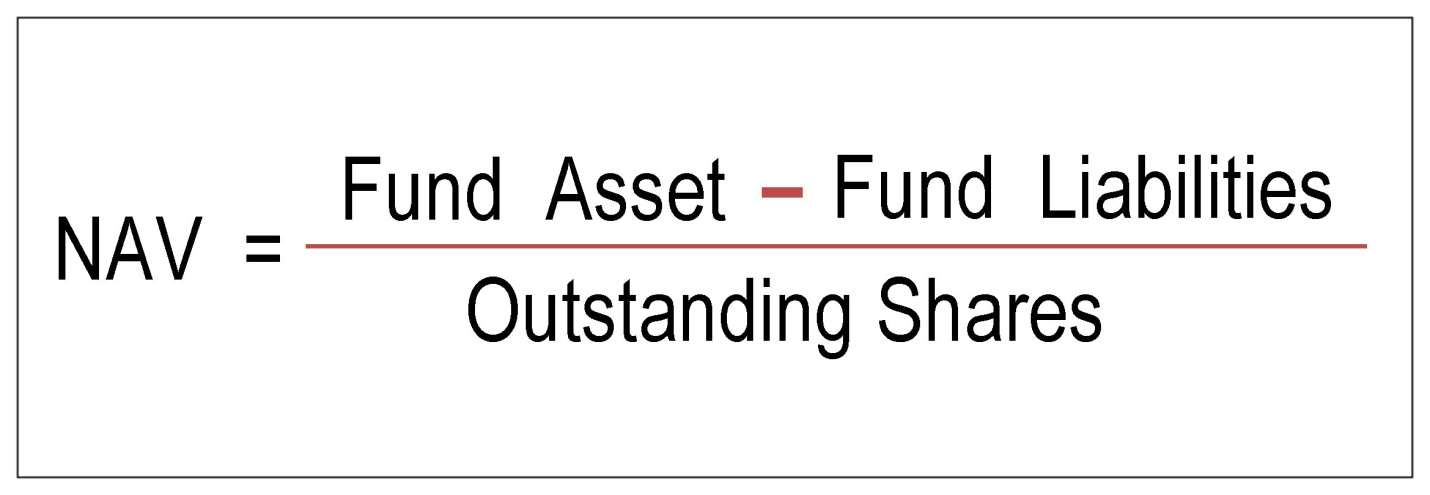

It is a trust that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and/or other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income/gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s “Net Asset Value or NAV. Simply put, a Mutual Fund is one of the most viable investment options for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

The performance of a particular scheme of a Mutual Fund is denoted by Net Asset Value (NAV). In simple words, NAV is the market value of the securities held by the scheme. Mutual Funds invest the money collected from investors in securities markets. Since market value of securities changes every day, NAV of a scheme also varies on day to day basis. The NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on any particular date.

The performance of a particular scheme of a Mutual Fund is denoted by Net Asset Value (NAV). In simple words, NAV is the market value of the securities held by the scheme. Mutual Funds invest the money collected from investors in securities markets. Since market value of securities changes every day, NAV of a scheme also varies on day to day basis. The NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on any particular date.

The NAVs of all Mutual Fund schemes are declared at the end of the trading day after markets are closed, in accordance with SEBI Mutual Fund Regulations.

Many of us dread the thought of managing our own investments. With a professional fund management company, people are put in charge of various functions based on their education, experience and skills.

Many of us dread the thought of managing our own investments. With a professional fund management company, people are put in charge of various functions based on their education, experience and skills.

As an investor, you can either manage your finances yourself, or hire a professional firm. You opt for the latter when:

- You do not know how to do the job best – many of us hire someone to file our income tax returns, or almost all of us get an architect to do our house.

- You do not have enough time or inclination. It’s like hiring drivers even though we know how to drive.

- When you are likely to save money by outsourcing the job instead of doing it yourself. Like going on a journey driving your own vehicle is far costlier than taking a train.

- You can spend your time for other activities of your choice / liking

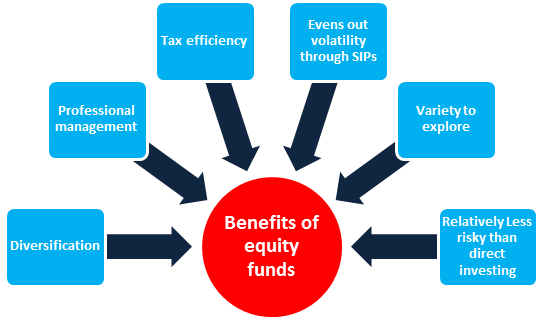

Professional fund management is one of the best benefits of Mutual Funds. The infographic on the left highlights all the others. Given these benefits, there is no reason why one should look at any other investment avenue.

Various types of Mutual Funds exist to cater to different needs of different people. Largely, they are of three types.

- Equity or Growth Funds

- These invest predominantly in equities i.e. shares of companies

- The primary objective is wealth creation or capital appreciation.

- They have the potential to generate higher return and are best for long term investments.

- “Large Cap” funds which invest predominantly in companies that run large established business

- “Mid Cap” funds which invest in mid-sized companies.

- “Small Cap” funds that invest in small sized companies

- “Multi Cap” funds that invest in a mix of large, mid and small sized companies.

- “Sector” funds that invest in companies that are related to one type of business. For e.g. Technology funds that invest only in technology companies

- “Thematic” funds that invest in a common theme. For e.g. Infrastructure funds that invest in companies that will benefit from the growth in the infrastructure segment

- Tax-Saving Funds

- Income or Bond or Fixed Income Funds

These invest in Fixed Income Securities, like Government Securities or Bonds, Commercial Papers and Debentures, Bank Certificates of Deposits and Money Market instruments like Treasury Bills, Commercial Paper, etc.

These are relatively safer investments and are suitable for Income Generation.

Examples would be Liquid, Short Term, Floating Rate, Corporate Debt, Dynamic Bond, Gilt Funds, etc. - Hybrid Funds

These invest in both Equities and Fixed Income, thus offering the best of both, Growth Potential as well as Income Generation.Examples would be Aggressive Balanced Funds, Conservative Balanced Funds, Pension Plans, Child Plans and Monthly Income Plans, etc.

Thus if an investor was to invest Rs. 50,000 in an ELSS, then this amount would be deducted from the total taxable income, thus reducing her tax burden.

These schemes have a lock-in period of three years from date of units allotment. After the lock-in period is over, the units are free to be redeemed or switched. ELSS offer both growth and dividend options. Investors can also invest through Systematic Investment Plans (SIP), and investments up to ₹ 1.5 lakhs, made in a financial year are eligible for tax deduction

The money is lying idle for a short period of time. In certain cases, the exact time when the money needs to be taken out may not be known. What does the investor do? Where should the money be parked?

One must consider a few things here:

- The money is parked for a short period of time

- One would prefer that there is no drop in investment value

- Even low returns should be fine, if it means the money is safe

- The period may not be fixed or even known

Given the above four conditions, putting money in a fixed deposit may serve the purpose, but only to a limited extent. One of the big benefits of a fixed deposit is the safety. At the same time, one of the limitations is often ignored – the money can be parked for a fixed period only – there is no flexibility regarding the period of parking.

That is where liquid mutual funds could be considered. They offer safety, reasonably good returns (in comparison to savings accounts or even very short term fixed deposits) and full flexibility of redemption any time.

Equity Funds are either Active or Passive. In an Active Fund, a fund manager scans the market, conducts research on companies, examines performance and looks for the best stocks to invest. In a Passive Fund, the fund manager builds a portfolio that mirrors a popular market index, say Sensex or Nifty Fifty.

Furthermore, Equity Funds can also be divided as per Market Capitalisation, i.e. how much the capital market values an entire company’s equity. There can be Large Cap, Mid Cap, Small or Micro Cap Funds.

Also there can be a further classification as Diversified or Sectoral / Thematic. In the former, the scheme invests in stocks across the entire market spectrum, while in the latter it is restricted to only a particular sector or theme, say, Infotech or Infrastructure.

Thus, an equity fund essentially invests in company shares, and aims to provide the benefit of professional management and diversification to ordinary investors.

Similarly, an investor in a Mutual Fund can select and invest individually in various schemes, e.g. equity fund , debt fund , gold fund , liquid fund , etc. At the same time, there are schemes like a combo meal – known as hybrid schemes. These hybrid schemes invest in two or more asset categories so that the investor can avail the benefit of both. There are various types of hybrid funds in the Indian Mutual Fund industry. There are schemes that invest in two assets, viz., equity and debt, or debt and gold. There are also schemes that invest in equity, debt and gold. However, most of the popular hybrid schemes invest in equity and debt assets.

Different types of hybrid funds follow different asset allocation strategies. Remember to have your objectives clear before you invest.

A few major advantages of investing in debt funds are low cost structure, relatively stable returns, relatively high liquidity and reasonable safety.

Debt funds are ideal for investors who aim for regular income, but are risk-averse. Debt funds are less volatile and, hence, are less risky than equity funds. If you have been saving in traditional fixed income products like Bank Deposits, and looking for steady returns with low volatility, debt Mutual Funds could be a better option, as they help you achieve your financial goals in a more tax efficient manner and therefore earn better returns.

In terms of operation, debt funds are not entirely different from other Mutual Fund schemes. However, in terms of safety of capital, they score higher than equity Mutual Funds.

“Mutual Funds could be a good saving tool for short term.”

“You must be patient with your Mutual Fund investments. It takes time to deliver results.”

People regularly come across both the above statements, which are clearly contradictory.

So what period are Mutual Funds suitable for? Short term or long term?

Well, that depends on what one’s investment goals are, and most goals are driven by time. There are schemes suitable for short periods, there are several schemes suitable for longer horizon, and then, there are schemes for any period in-between.

Consult your Mutual Fund distributor or your investment advisor, discuss your financial goals, and then decide where you want to invest. For example;

- Equity-oriented Mutual Funds- Look for longer periods, typically 5 years and above.

- Fixed Income oriented Mutual Funds-

- Liquid Funds - For very short term – Less than 1 year

- Short Term Bond Funds – For the medium term – 1 to 3 years.

- Long Term Bond Funds - For the long term – 3 years or more

As you explore our website, you will know more about the various kinds of Mutual Funds too. So, trust the expertise of your advisor, know your goals, and invest!

Suresh looked at the income opportunity and decided to enjoy life. Rahim, on the other hand, decided to save and invest his earning, in order to survive in the city.

Rahim was concerned when he learnt about Suresh’s lifestyle and tried explaining him the benefits of saving young with numbers.

Rahim had started investing at the age of 25. He was investing ₹ 5,000 per month and earned @10% p.a. on his investments. In all, he would invest ₹ 21 lacs and accumulate a sum of ₹ 1.70 crores at 60 years of age.

If Suresh started investing ₹ 30,000 per month even at the age of 46, his total investment over the years would be ₹ 54 lacs. Earning @10% per year on his investments, he would accumulate less than ₹1.2 crores when he’s 60.

Although Suresh invested ₹ 54 lacs as against Rahim’s ₹ 21 lacs and both earned at the same rate of return, Rahim would accumulate a larger sum due to the time he gave to his investments. Starting early started the magic, and the power of compounding did the rest.

There is no reason why one should delay one’s investments, except, of course, when there is no money to invest. Within that, it is always better to use Mutual Funds than to do-it-oneself.

There is no minimum age when one can start investing. The moment one starts earning and saving, one can start investing in Mutual Funds. In fact, even kids can open their investment accounts with Mutual Funds out of the money they receive once in a while in form of gifts during their birthdays or festivals. Similarly, there is no upper age for investing in Mutual Funds.

Mutual Funds have many different schemes suitable for different purposes. Some are suitable for growth over long periods, whereas some may be for those in need of safety with regular income, and some provide liquidity in the short term, too.

You see, whatever stage of life one is in, or whatever one’s requirements, Mutual Funds may have solutions for each one.

Every investment we make involves a risk, only its nature and degree varies. The same applies to Mutual Funds too.

Every investment we make involves a risk, only its nature and degree varies. The same applies to Mutual Funds too.

All Mutual Fund schemes do not carry the same risk when it comes to returns on investment.

Equity schemes have the potential to deliver superior returns over the long term that can create wealth. Remember, inflation is a risk, and equities are the best asset class to beat inflation. So, in a sense, there are some risks that are worth taking.

On the other hand, the risk associated with liquid funds is significantly low when compared to equity funds. A liquid fund focuses on the protection of capital by taking lower risk and generating returns in line with the risk taken.

It is also important to remember that the risk on returns is not the only risk you need to consider. There are other risks – liquidity risk for instance. Liquidity risk measures the ease in converting your investment into cash. This risk is lowest in Mutual Funds.

In the end, the nature and extent of risk is best understood through proper understanding and evaluation of the scheme and by taking the guidance of a Mutual Fund distributor or an investment advisor.

The fund manager is similar to a surgeon in an operation theatre. Though it is the surgeon who actually does the critical operational procedure, he is assisted by assistant surgeons, anaesthetists, nurses and other support staff. Similarly, the fund manager is assisted by the research team, junior fund managers and an operations team. Just as a surgeon has all the latest equipment to ensure a successful operation, the fund manager has access to the latest information, reports and analysis.

An experienced fund manager would have seen many economic cycles, business developments, political and policy changes. Such issues have a bearing on investment performance. Since all these issues are normally beyond the grasp of an average investor, a fund manager brings not just their own expertise and competence, but also the collective wisdom from the information and data that he has access to.

Once an investor has decided to invest in Mutual Funds, he has to make a decision of which scheme to invest in – Fixed Income, Equity or Balanced and which Asset Management Company (AMC) to invest with?

Once an investor has decided to invest in Mutual Funds, he has to make a decision of which scheme to invest in – Fixed Income, Equity or Balanced and which Asset Management Company (AMC) to invest with?

Firstly, discuss freely with your advisor what your objective is, what time period you’re comfortable with, and what your risk appetite is.

Decisions on which fund to invest in would be made based on this information.

- If you have a long term objective – say, retirement planning, and are willing to assume some risk, then an Equity or Balanced Fund would be ideal.

- If you have a very short term objective – say, money to be kept aside for a couple of months; a Liquid Fund would be ideal.

- If the idea is to generate regular income, then a Monthly Income Plan or an Income Fund would be recommended.

After deciding on the type of fund to invest in, a decision on the specific scheme from an AMC would have to be made. These decisions are usually made after ascertaining the AMC’s track record, suitability of scheme, portfolio details, etc.

Scheme Factsheets and Key Information Memorandum are two documents that every investor needs to peruse before investing. If one needs detailed information then one should look at Scheme Information Document. All of these are easily accessible at every Mutual Fund’s website.

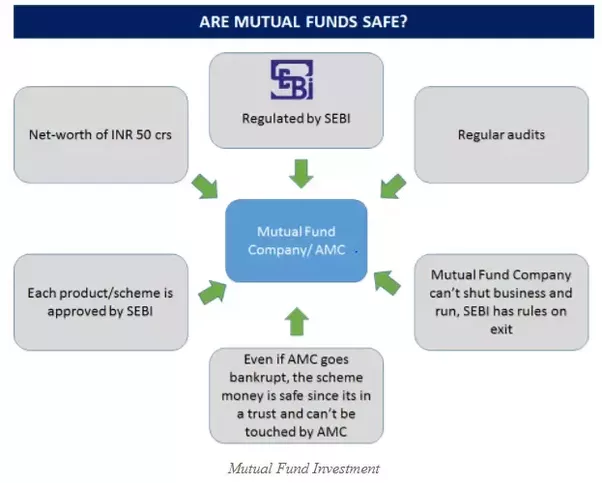

All Mutual Funds in India are regulated by the Securities and Exchange Board of India (SEBI). Mutual Fund regulations clearly define the roles and responsibilities of Asset Management Companies (AMC) and Custodians. It’s vital to remember that every investor has to complete an effective KYC process before investing. Therefore, only bonafide investors with a valid PAN card can invest in Mutual Fund schemes. Such investors also provide bank details so that all redemption proceeds are directly credited to an investors own account.

All Mutual Funds in India are regulated by the Securities and Exchange Board of India (SEBI). Mutual Fund regulations clearly define the roles and responsibilities of Asset Management Companies (AMC) and Custodians. It’s vital to remember that every investor has to complete an effective KYC process before investing. Therefore, only bonafide investors with a valid PAN card can invest in Mutual Fund schemes. Such investors also provide bank details so that all redemption proceeds are directly credited to an investors own account.

SEBI also ensures that all AMCs are supervised by a board of trustees, some of whom, have to necessarily be independent individuals. These trustees ensure one more level of safeguards and compliance.

Regulations and safeguards ensure that it can never ever be misappropriated and diverted, and that, no one will run with your money.

Investors need to keep in mind any applicable exit load on their investment. Exit loads are charges deducted at the time of redemption, only if applicable. AMCs usually impose an exit load to deter short term or speculative investors from entering a scheme.

Closed end schemes do not offer this, as all units are automatically redeemed on the date of maturity. However, units of closed end schemes are listed at a recognised stock exchange, and investors can sell their units to others only through the exchange.

Mutual funds are one of the most liquid investment avenues in India, and are an ideal asset class for every financial plan.

The decision to redeem is totally at investor’s discretion. There are no restrictions on the number of redemptions, or on the amount to be redeemed. There have to be sufficient units in the account to fund redemptions. Scheme documents usually indicate minimum amount that can be redeemed.

Units under lien to a bank or institution cannot be redeemed, unless the lien is removed. Redemptions may be restricted only under extraordinary circumstances, as decided by the Board of Trustees.

Closed end schemes may be redeemed from the AMC only on maturity. However, they do provide a route to liquidity – any time before maturity - by selling units in a recognised exchange.

Redemptions can be made at;

- Investor Service Centres (ISCs)

- AMC offices

- Official Points of Acceptance of Transaction (OPAT)

- Through an authorised on-line platform.

Invest for long term – an advice routinely given by many Mutual Fund distributors and investment advisors. This is especially true in case of certain Mutual Funds – such as equity and balanced funds.

Invest for long term – an advice routinely given by many Mutual Fund distributors and investment advisors. This is especially true in case of certain Mutual Funds – such as equity and balanced funds.

Let us understand why the professionals give such advice. What really happens in the long term? Is there a benefit of staying invested for long term?

Consider your Mutual Fund investment as a good quality batsman. Every good quality batsman has a certain style of batting. However, each good quality batsman would be able to accumulate lots of runs, if he continues to play for years.

We are talking about the record of a “good quality” batsman. Every good batsman would go through some good and poor performances. On average the record would be impressive.

Similarly, a good Mutual Fund would also go through some ups and downs – often due to factors beyond the control of the fund manager. An investor would benefit if one stays invested through these funds for long periods of time.

So, as long as you can afford, stay invested for long periods of time – especially in equity and balanced funds.

Investments in Mutual Funds require the appropriate time horizon. Having the right time horizon, not only provides a better chance of getting expected, investment returns, but also lowers the risk in the investment.

Investments in Mutual Funds require the appropriate time horizon. Having the right time horizon, not only provides a better chance of getting expected, investment returns, but also lowers the risk in the investment.

Now what is this “risk” we are talking about? In simple terms, it is volatility of investment performance, as well as chances of eroding investment capital. By staying invested over the long term, some years of low/negative returns and some years of impressive returns will make the average returns quite reasonable. Therefore, the investor can ‘average out every year’s widely fluctuating returns’ to get a more stable long term return.

The recommended time horizon, differs for every asset class as well as Mutual Fund category. Please consult an investment advisor and read scheme related documents before making an investment decision.

Yes! Even for an investor with modest savings or small beginnings, Mutual Funds are an ideal investment vehicle.

Almost every investor, small or big, has a Savings Bank (SB) account, and anyone with that account can start investing through Mutual Funds. With amounts as low as ₹ 500 every month, Mutual Funds promote the healthy habit of regular investing.

Other benefits for a small investor in Mutual Funds are-

- Ease of transacting- Investing, reviewing, managing and redeeming from a Mutual Fund scheme are all simple processes.

- Easy liquidity, maximum transparency and disclosure, timely statements of accounts, and tax benefits are all that a small or first time investor looks out for.

- Dividends in Mutual Funds are tax free at the hands of the investor

- A Mutual Fund gives the same investment performance, to an investor who has invested ₹ 500 or one who has invested ₹ 5 crores. Thus it has every investor’s interests in mind – small or big.

- Professionally managed, diversified portfolio for someone who invests even ₹ 500 a month.

No matter how small the starting amount or modest the objectives, Mutual Funds Sahi Hai.

Systematic Investment Plan (SIP) is an investment route offered by Mutual Funds wherein one can invest a fixed amount in a Mutual Fund scheme at regular intervals– say once a month or once a quarter, instead of making a lump-sum investment. The installment amount could be as little as INR 500 a month and is similar to a recurring deposit. It’s convenient as you can give your bank standing instructions to debit the amount every month.

Systematic Investment Plan (SIP) is an investment route offered by Mutual Funds wherein one can invest a fixed amount in a Mutual Fund scheme at regular intervals– say once a month or once a quarter, instead of making a lump-sum investment. The installment amount could be as little as INR 500 a month and is similar to a recurring deposit. It’s convenient as you can give your bank standing instructions to debit the amount every month.

SIP has been gaining popularity among Indian MF investors, as it helps in investing in a disciplined manner without worrying about market volatility and timing the market. Systematic Investment Plans offered by Mutual Funds are easily the best way to enter the world of investments for the long term. It is very important to invest for the long-term, which means that you should start investing early, in order to maximize the end returns. So your mantra should be - Start Early, Invest Regularly to get the best out of your investments.